The future of the financial services industry – centred in the City of London – matters enormously to the health of the United Kingdom’s economy. The Trade and Co-operation Agreement (TCA) has few provisions on financial services and the UK now appears set to drive a wedge between EU and British rules so it can “benefit” from its new-found Brexit freedom. In reality, this “wedge” is unlikely to benefit the economic prospects of the City or the United Kingdom.

There can be no doubt that the EU will use the “autonomy of its decision-making process” – as stressed in the TCA. If the UK wishes to row alongside the EU super-tanker and “take” its rules, then the UK will remain “equivalent[1]”. But current UK policy intentions suggest there will be an ever-widening gulf by the end of this Commission’s term in 2024 – as the logical outcome of UK policy. The internationally mobile financial services industry will undoubtedly take account of this probability in planning the location of future business opportunities.

How might this play out by say 2024? Could the divergence cause the end of the City’s dominance of European finance? It might well do.

Size matters

The relative scale of the EU and UK economic systems after the Brexit cleavage needs to be kept firmly in mind. The City makes a great play about the location of trading in euro-denominated investment assets such as equities, bonds and derivatives. But the euro assets being traded overwhelmingly belong to EU savers – not British – as the data below show:

- 59 CET January 31, 2020: European Union financial service rules applied to €25 trillion of investment assets belonging to 513 million EU citizens and others (e.g. sovereign wealth funds) – derived from the EU’s €16.4 trillion GDP

- 01 CET February 1, 2020: British financial services rules applied to €6 trillion of investment assets belonging to 67 million UK citizens derived from the UK’s €2.6 trillion GDP, and €3 trillion belonging to foreigners. According to the 2021 edition of the City of London Corporation’s “Total tax contribution of UK financial services”, UK financial services contributed £75.6 billion in 2019/20, similar to the 2019 total and the highest total since the survey began in 2007. The financial services sector employed 3% of the UK workforce, generating 7% of economic output and close to 10% of total UK Government revenue – £825 billion in 2019/20. (To illustrate the significance of this contribution, replacing say half would require[2] the basic rate of income tax to rise from 20p to 28p in the £.)

Data sources: European Commission, City of London Corporation, European Fund and Asset Management Association

The TCA and financial services

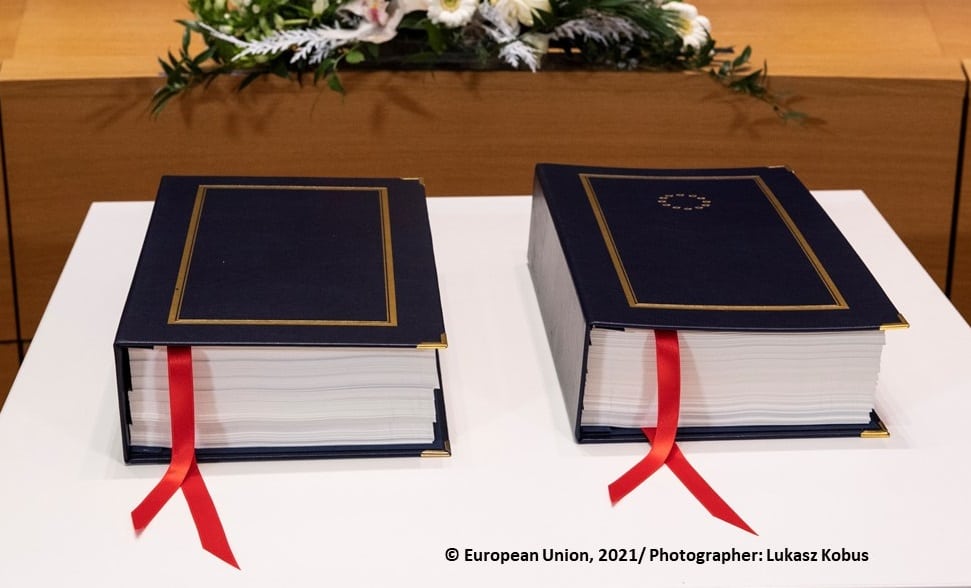

The treaty texts are indeed massive – running to 1259 pages – but only about six pages are relevant to financial services and largely covered in just four Articles.

The Commission provides a simple Q&A to illustrate that the TCA has treated financial services in much the same way as in the EU’s other Free Trade Agreements (FTAs). Crucially, it is very explicit about equivalence in an effort to dispel some illusions in the UK: “The Agreement does not include any elements pertaining to equivalence frameworks for financial services. These are unilateral decisions of each party and are not subject to negotiation.” (Details in the Technical Appendix)

The Commission provides a simple Q&A to illustrate that the TCA has treated financial services in much the same way as in the EU’s other Free Trade Agreements (FTAs). Crucially, it is very explicit about equivalence in an effort to dispel some illusions in the UK: “The Agreement does not include any elements pertaining to equivalence frameworks for financial services. These are unilateral decisions of each party and are not subject to negotiation.” (Details in the Technical Appendix)

There is an “MoU” to be agreed by March 2021 and some commentators appeared to believe that it would be the mechanism to introduce a wide range of equivalence decisions. However, reading the actual text (link) should disabuse any expectations about the EU giving up any of its autonomy. The MoU may well amount to little more than an agreement to talk to each other – presumably with appropriate telephone numbers/e-mail addresses provided!

UK policy intentions after Brexit

Three policy statements – a useful starting point for analysis

- The scene was set in October 2020 when the Treasury launched a review of financial regulation. The Ministerial Foreword by John Glen (the eighth Economic Secretary since 2010) was explicit about the aims: “Leaving the EU means the UK has the opportunity to take back control of the decisions governing our financial services sector. We can now be guided by what is right for the UK, regulate differently where we need to, and regulate better…. the government is also determined to seize opportunities to provide policy leadership in key areas of financial regulation, including on Green Finance and a low carbon future, fintech and payments innovation, financial crime, financial inclusion and the levelling-up agenda.”

- According to the Financial Times (FT) on 11th January 2021, “Chancellor Sunak told MPs in the House of Commons that the conclusion of the Brexit process would now allow Britain to “start doing things differently and better” in terms of regulation.” The FT reported that the Chancellor went on to say “Referring to Brexiters who claimed that the City could now enjoy another 1980s style leap forward, Mr Sunak told City AM that they “make a really, really good point”. Referring to the Thatcher-era deregulation reforms that opened up the City to more competition and foreign investment, Mr Sunak added that people were free to “call it Big Bang 2.0 or whatever”

- Bank of England Governor Bailey also appeared before the Treasury Select Committee: “Will the UK become a rule taker in financial services? In our session with the Bank of England yesterday, Andrew Bailey told us: “I would strongly recommend that we do not become a rule-taker. […] If the price of that is no equivalence then I am afraid that will follow.”

All these statements imply that British polices may well be radically different in future, and that the UK will certainly not feel bound to “take” any future EU rules. Instead, the UK may well seek to “lead” international rules. The stage may now be set for a period of serious divergence in rules – driven by the new goals of UK regulatory policy.

Some analysis of the policy implications

- How will UK-based market participants respond to any radical changes? The FT reported “City of London bosses warn against post-Brexit deregulation. Business chiefs say there is little need for wholesale rule changes in the UK.” If there is no particular appetite for UK rule changes, it begs the obvious question: what happens when EU rules change – as they surely will as it seeks to meet its stated goals of strengthening the monetary union and responding to Covid/climate change (see below).The process of changing rules also matters enormously to market participants – if the new rules are to command respect and therefore compliance. The Treasury’s consultation on the Future Regulatory Framework has just closed and our Technical Appendix contains some key extracts about the process. “The government proposes a general arrangement whereby the regulators consult HM Treasury more systematically on proposed rule changes at an early stage in the policy-making process and before proposals are published for public consultation… It would not give Ministers a veto over the regulators’ rule-making functions or act as a constraint around the regulators’ policy discretion when designing rules.”Anyone familiar with “Yes Minister’s” Sir Humphrey Appleby may notice striking parallels when reading this officialese! Carefully translating the officialese into plain English, this means that “Ministers” (the Economic Secretary for this year), let alone the elected Members of Parliament, will not have “taken back control”. Instead, Brexit will have taken power away from the people and handed it to the officials – Sir Humphrey (aka “Sir Braddick-Bailey”[3] ).Market participants are now used to the open, inclusive EU process and may not be willing to buy in to `Sir Braddick-Bailey’s’ new British rules when globally-accepted EU rules are already being used – especially after a major `sunk cost’ investment in compliance. Moreover, they will need to ask if UK rules will make firms acceptable to their trading counter-parties and customers.

There will be a narrow band of acceptability for these new rules:

(i) If the levels of, say, required capital – always a key issue – are raised beyond standards in competing jurisdictions, then firms will migrate to the cheaper area.

(ii) Conversely, if capital adequacy is lowered in the UK, banks elsewhere may face capital add-ons to reflect their exposure to apparently-weaker UK firms.

(iii) However, the third option is politically the most fascinating: if rules remain closely aligned as EU rules change, then the UK will have become a vassal “rule-taker” so Brexit was entirely pointless. Hardly the clarion call of the Leavers!

- Will the new UK process reflect `best endeavours’ to implement international standards – as agreed in TCA Article 5.41? Existing EU Directives/Regulations to implement the current international standards were all agreed by the UK – both as a member state of the EU and as a member of the relevant international fora. It will be a fine, nuanced line to remain compliant with the international rules while deviating from the EU’s implementing rules. (There are a limited number of instances where the EU chose not to implement some of the international rules.)“Leading” the international standard-setters may well take the UK out of compliance as extremely cumbersome international bodies seek to catch up some years later with the UK’s “agile rule-making powers” – a potentially clear breach of the “best endeavours” obligation undertaken in the TCA. Sensible suggestions remain sensible whatever the country of origin. However, if “agile” British suggestions turn out to be designed to undercut EU rules, then the EU and its member states weigh much more heavily in these fora than the UK. Clearly, this would not be a process that would induce the EU to make wide-ranging findings of equivalence between EU and UK rules.

EU financial policy objectives: 2019 – 2024

UK commentators and academics devote much effort to studying the details of policy proposals from the EU in an attempt to infer the underlying policy goals – a kind of reverse-engineering. However, there is an easier (and more certain) approach: simply read the policy goals formally adopted by the EU’s co-legislators – the European Parliament and the Council of the EU.

Every five years, a new European Commission is elected to office – upon nomination by the Member States and then election by the European Parliament as direct representatives of the peoples of Europe. In September 2019, Ursula von der Leyen (UvL) published her “Agenda for Europe” – the Political Guidelines for the incoming Commissioners for the period 2019-24. This Agenda is the equivalent of a British political party’s Manifesto. Unsurprisingly, the civil service – in this case, the Commission Services – then set about implementing the new policies mandated by Europe’s democratic system.

The Agenda stated “A strong, integrated and resilient capital market is the best starting point for the single currency to become more widely used internationally.” (More) These goals define what the EU sees as its “interests” and it has stated unequivocally in the TCA that it reserves its autonomy to pursue its “interests”.

About a year later, DG FISMA (Financial Stability, Financial Services and Capital Markets Union) published its “Strategic Plan 2020-2024” to deliver these policy goals, naturally taking the Commission’s political agenda as the starting point. As would be expected in a management strategy, the texts are accompanied by Key Performance Indicators – 10 pages of them. The plan is to calibrate objectives in every field of financial activity. The EU has detailed its “interests” and the means of measuring progress in achieving them. This is “autonomy” in action.

Some of this work was already underway before the new Commission took office. But a glance at the list of Consultations since then shows 19 items that cover most aspects of banking, capital markets, asset management, insurance, and payments systems – as well as digital and sustainable finance. A hallmark of the EU’s system of financial regulation since the 2001 Lamfalussy Report has been regular reviews of existing legislation. All measures since then have incorporated a review requirement – usually after two years in force – to ensure the legislation remains up to date with technology and market developments (currently those driven by Covid) yet ensures financial stability through proper prudential standards.

The entire development of the Single Market during Britain’s membership has been designed to incorporate these “prudential” goals since EU Commissioner Lord Cockfield’s White Paper “Completing the Internal Market”, was published in 1985. This 300-directive programme implemented Mrs Thatcher’s vision of a single market throughout the EU and came into force in 1992. Successive waves of subsequent financial services legislation responded to market and technological developments. The global financial crash of 2007-9 produced a tsunami of reactions and the combination of Covid and climate change is triggering another.

Accordingly, it is a racing certainty that virtually every aspect of the EU’s body of financial regulation will be reviewed by 2024 – even if legislative proposals are not fully enacted by then. This acquis (and the implementing measures of the European Supervisory Agencies) has now grown into something of a super-tanker as national rules are steadily replaced by European rules designed to provide a genuinely single market. There will be tweaks on the rudder at times, and maybe significant course corrections as storms such as the Covid pandemic hit. But the EU’s course is clear and will take no account of the “interests” of a former member that is about one-sixth of its size. Why should it?

Some recent developments

- If US dollar financial activity gravitates back into the jurisdiction of its “central bank of issue” (the natural home?) and the EU succeeds in its goal of moving the international role of the euro towards its economic weighting, then what is left for the UK? The trading of EU shares shifted from London the moment the transition period ended, and is now barely 4% of the UK total – down from 43% in 2019. The UK share of trading in interest rate swaps has also fallen significantly already – probably the most totemic measure of financial power.

- In the massive new field of sustainable finance, the EU has already – and intentionally – established a global lead in setting standards such as the EU Taxonomy. It is a classification system for environmentally sustainable economic activities that was developed by the European Commission. Global market players seem to be adopting this system. Is there room for a rival UK system? Intercontinental Exchange (ICE) has just announced plans to move its €1 billion daily market for European carbon emissions contracts to the Netherlands from London – a significant blow to U.K. aspirations to build a `green finance’ powerhouse after Brexit.

- One of the most hotly debated issues is the movement of jobs from London to the EU as it is an extremely sensitive issue for firms – for relations with both staff and government. Ernst and Young’s most recent Brexit Tracker states “The number of jobs that could relocate from London to the EU remains flat at around 7,000. Alongside relocating UK staff, Firms are continuing to hire locally on the continent as a result of Brexit. Since the Referendum, 43 Financial Services Firms have announced plans to make local hires for existing or newly created roles, equating to over 2,400 new jobs.”

This approach highlights that jobs may well shift by switching recruitment for new posts from the UK to the EU. Morgan McKinley’s data (left) shows a strong reduction in UK recruitment as firms implemented their Brexit plans.

This approach highlights that jobs may well shift by switching recruitment for new posts from the UK to the EU. Morgan McKinley’s data (left) shows a strong reduction in UK recruitment as firms implemented their Brexit plans.

But the Brexit pressures are superimposed on other driving forces – Covid most recently. Many firms have realised that their staff can achieve much by working from home. But does that home have to be in the UK and close to the City? Technology has delivered the means to disperse employment – challenging the old ideas of critical mass in `localised clusters’ such as the City of London.

As a student 50 years ago, this author recalls that Stock Exchange firms were obliged to have their office within 400 yards of the Exchange so that messengers (including students!) could quickly walk round to banks with bearer securities that were just pieces of paper. A necessary technique was to stick a foot in the bank’s door to stop it being closed (at 3pm sharp) while the security was delivered against a cheque drawn on the Bank of England: delivery versus payment!

All that was swept away long ago and Covid may have accelerated the next phase. Half a century ago, banks and stockbrokers clustered close to the Bank of England; insurance close to Lloyds of London; shipping round the Baltic Exchange etc. Now, the exchanges are clustering in Amsterdam, the asset managers in Dublin or Luxembourg; mid-offices in Warsaw etc. But they are all linked by technology so that physical location is increasingly unimportant.

The EY Brexit trackers show how firms have been preparing for a `hard Brexit’ for quite some time – as they were required to – very forcefully by the regulators on both sides of the Channel. EU regulators are now insisting these plans be fully implemented. Once these changes have been made, would firms dismantle their new structures if there were a sudden rash of equivalence decisions by the Commission in the fullness of time? They might contemplate that the Commission decisions are unilateral and can be withdrawn at short notice. As they observe the probable gulf between UK and EU rules opening up (see above), what chance of any equivalence decisions surviving for long? In any case, the TCA itself is up for review in five years. Might parts of it (for example, in financial services) just be allowed to lapse if the UK has systematically breached its commitments e.g. on `best endeavours’?

The financial services industry is very innovative so the question always has to be answered: where to locate the new “sunrise” business? It is all too clear where the “sunset” businesses are located – London. There is a danger that these “sunrise” businesses will gradually migrate to the EU. If for instance an originally UK-based organisation sends a few of its key and most profitable staff to Amsterdam, then the business there will be hugely profitable because all the back-office costs are still booked in the UK. Dutch tax inspectors will notice the `super profits’ generated in their country and want their fair share of the tax take. The natural commercial response will then be to shift those back-office costs into the EU entity in [Amsterdam] to minimise the `super profits’ subject to [Dutch] tax. Such a process would be spread over several years but the logic is inexorable – leading to reduced profits (and therefore taxes) in the UK as revenues/profits are now located in the [Netherlands]. As UK tax revenues fall, could that be the trigger for the standard rate of UK income tax rising from 20p to 28p?

Brexiteers may not have grasped that the international financial services industry is both highly mobile and highly profit-seeking. After an initial burden of `sunk costs’ from post Brexit re-configurations, the international financial services industry will not be damaged, but its former home – the UK – may well be.

The revenues that leave the UK will not all go to the EU but maximising purely `economic transactions’ has never been the EU’s objective. Instead, it continues to strive for the vison of European unity launched by Churchill in his series of great speeches after World War II. The modern, mile-stone along the long road to achieving that objective is to maintain the financial stability of the Single Market – through the mechanisms agreed for the period 2019-24 in the election of the current European Commission. If British financial rules are not designed to achieve the same outcome, then they cannot be “equivalent”.

The Brexit chickens are quickly coming home to roost after only a month. Quelle surprise! Amsterdam has overtaken London in share trading and will be the new home for trading the ICE carbon contract. Swap Execution Facilities (SEFs) in the US are seeing a rising share of derivatives trading. Apparently technical changes – but the jobs that operate these activities (and the taxes) are on the move very quickly. In perhaps half a decade, the City may look very different – with major impacts on the UK’s tax revenues, employment and foreign exchange earnings. But the global financial services industry will have accommodated itself permanently to the new situation.

Technical Appendix

Key TCA provisions on financial services

- Article 3.5 – Most Favoured Nation provisions are specifically dis-applied to “prudential measures” as defined in GATS. This is the well-known “prudential carve out” (more below)

- Article 5.38 Definitions. — seems to be a comprehensive listing of most significant financial services activities embedded in existing EU regulations

- Article 5.39: “Prudential carve-out”. The article is extremely specific that a Party can maintain “measures for prudential reasons… protection of investors, depositors… or ensuring the integrity and stability of a Party’s financial system”.

- Article 5.41 commits both Parties to “make their best endeavours” to implement “international standards” agreed by the usual international fora: G20, Financial Stability Board etc.

- Finally, there is a “Joint declaration on financial services regulatory cooperation…”

In more detail:

The Commission has published a useful set of Q&As to summarise these massive texts. The key issue is whether the EU will find UK regulations provide “equivalence” to its own. (Author’s emphasis added.)

“Does the Agreement cover financial services?

The draft EU-UK Trade and Cooperation Agreement covers financial services in the same way as they are generally covered in the EU’s other FTAs with third countries.

In particular, the Agreement commits both parties to maintain their markets open for operators from the other Party seeking to supply services through establishment. The parties also commit to ensuring that internationally agreed standards in the financial services sector are implemented and applied in their territories. Both parties preserve their right to adopt or maintain measures for prudential reasons (‘prudential carve-out’), including in order to preserve financial stability and the integrity of financial markets. The parties will also aim to agree by March 2021 a Memorandum of Understanding establishing a framework for regulatory cooperation on financial services.

“What about the equivalence decisions on financial services?

The Agreement does not include any elements pertaining to equivalence frameworks for financial services. These are unilateral decisions of each party and are not subject to negotiation.

The Commission has assessed the UK’s replies to the Commission’s equivalence questionnaires in 28 areas. A series of further clarifications will be needed, in particular regarding how the UK will diverge from EU frameworks after 31 December, how it will use its supervisory discretion regarding EU firms and how the UK’s temporary regimes will affect EU firms. For these reasons, the Commission cannot finalise its assessment of the UK’s equivalence in the 28 areas and therefore will not take decisions at this point in time. The assessments will continue. The Commission has taken note of the UK’s equivalence decisions announced in November, adopted in the UK’s interest. Similarly, the EU will consider equivalence when they are in the EU’s interest.”

HMT Treasury

- (2) “The government’s proposed approach involves moving regulatory requirements that apply directly to firms and markets from the UK statute book and into the regulators’ rulebooks…”

Some of its phraseology is quite wonderful [author’s emphasis added] e.g. 3.31 “The government proposes a general arrangement whereby the regulators consult HM Treasury more systematically on proposed rule changes at an early stage in the policy-making process and before proposals are published for public consultation. The aim here is to give the Treasury sufficient time to consider any broader public policy implications that regulator proposals may have and to allow the opportunity to feed back views to the regulators if necessary. It is important to stress that this policy coordination arrangement would only allow the Treasury to feed in views as regulator policy is being developed. It would not give Ministers a veto over the regulators’ rule-making functions or act as a constraint around the regulators’ policy discretion when designing rules.”

Commission

- UvL’s Agenda specified “I will prioritise the further deepening of the Economic and Monetary Union…. I will also focus on completing the Banking Union. This includes a common backstop to the Single Resolution Fund, a last-resort insurance measure in the event of a bank resolution… we need a European Deposit Insurance Scheme… These are the missing elements of the Banking Union… I will also put forward measures for a robust bank resolution and insolvency framework. I want to strengthen the international role of the euro …, A strong, integrated and resilient capital market is the best starting point for the single currency to become more widely used internationally.”

- About a year later, DG FISMA (Financial Stability, Financial Services and Capital Markets Union) published its “Strategic Plan 2020-2024” to deliver these policy goals, naturally taking the Commission’s political agenda as the starting point. “DG FISMA will concentrate its efforts on achieving the goal of the Commission’s political headline ‘an Economy that works for people’. It should be underlined that DG FISMA’s specific objectives and initiatives will also contribute to achieving other Commission’s political priorities, such as a European Green Deal, Europe fit for the digital age and a stronger Europe in the world. DG FISMA will also contribute to the work in the context of the EU recovery plan, which will guide and build a more sustainable, resilient and fairer Europe for the next generation”. This last point reflects the impact of Covid on the EU economy and its financial system.

- Again – as would be expected in any management process – the multi-year strategy is broken down into annual deliverables – the Management Plan 2020: “Part 1 of the Annual Management Plan focuses on delivering on the Commission’s priorities. It presents the expected deliverables of DG FISMA stemming from new policy initiatives, regulatory simplification actions, evaluations and fitness checks, consultations, enforcement actions and communication activities. All actions are linked to DG FISMA’s specific objectives as outlined in the Strategic Plan. A detailed annex with performance tables presents the actions and provides the expected delivery times.”

Notes

[1] The TCA states that “equivalence” means the capability of different laws, regulations and requirements, as well as inspection and certification systems, of meeting the same objectives. So “equivalence” does not require word-by-word matching but an equivalent outcome. This is determined unilaterally by the European Commission itself and “the EU will consider equivalence when they are in the EU’s interest.” – see Q&A in the Technical Appendix

[2] HMRC tax ready reckoner: 1p on basic rate of income tax would raise about £5 billion

[3] A composite of Katherine Braddick – HMT Director General, Financial Services and Andrew Bailey – Governor of the Bank of England

[…] Brexit: Ending the City’s Dominance of European Finance? Blog by Graham Bishop, 12th February 2021 […]

[…] for monetary providers, since commerce agreements usually don’t cowl them a lot. By one rely, the 1,259-page TCA (which remains to be unratified by the European Union) accommodates solely […]

[…] an in-depth analysis of the threat to London as a financial centre read this longer piece from the Federal Trust by Graham Bishop, a leading financial […]

[…] little for financial services, since trade agreements typically do not cover them much. By one count, the 1,259-page TCA (which is still unratified by the European Union) contains only six pages […]

[…] comparatively little for financial services, since trade agreements typically barely cover them. By one count, the TCA that was eventually approved (albeit still unratified on the EU side) contains only six […]

[…] The supervisor of the Federal Count On, Brendan Donnelly, reviews with Graham Diocesan, Professional on European Assimilation as well as Owner of grahambishop.com, his newest write-up qualified “Brexit: Ending the City’s Dominance of European Finance?” (offered on the Federal Trust fund web site: https://fedtrust.co.uk/brexit-ending-the-citys-dominance-of-european-finance/) […]

[…] The director of the Federal Trust, Brendan Donnelly, discusses with Graham Bishop, Consultant on European Integration and Founder of grahambishop.com, his latest article entitled “Brexit: Ending the City’s Dominance of European Finance?” (available on the Federal Trust website: https://fedtrust.co.uk/brexit-ending-the-citys-dominance-of-european-finance/) […]

[…] Brexit: Ending the City’s Dominance of European Finance? […]