“I hadn’t quite understood the full extent of this but …. we are particularly reliant on the Dover-Calais route.”

Dominic Raab, 20 November 2018, subsequently Foreign Secretary 2019 to 2021, revealing his unsuitability for the post.

Introduction

The formal enactment of Brexit came into force on January 31st 2020, complete with a transitional agreement to add bells and whistles to the Withdrawal Agreement. What may have started out as a “simple”, “oven ready” agreement, has morphed into a document 2,500 pages long. It includes many chapters, and also specifies, in detail, rules affecting trade between the UK and the EU. Judging by subsequent reactions in Britain, one might guess that virtually no one in the UK government has actually read the entire treaty from start to finish. If they had, then they would have been less surprised by subsequent events.

This paper examines how international trade has developed between Britain and the EU since the end of 2019 to mid 2021. Expectations varied hugely. Leavers saw the near future as being one of “regaining control”, throwing off the ill effects of Brussels bureaucracy, and rapidly signing new free trade agreements with other countries signalling a return to a “global Britain”, as Drake like buccaneers would bully nations across the world with the benefits of increased trade with the UK. Above all else, Leavers were looking for a marked short run improvement in Britain’s economic fortunes, such as higher trade and output volumes, and a reduction in trade with the EU. This has not happened.

Remainers were convinced that “doom and gloom” was imminent. Cut off from the country’s main trading partner, the EU, substitutes would be hard to find. Trade volumes would drop. Trade surpluses (where they existed) would shrivel up, as UK exports struggled to absorb the additional costs of doing business with the EU. Profit margins would slump, and Britain’s engagement in international trade would become more inwardly focused and more distant from global supply chains. What was left unsaid was whether the UK, in time, would also become more protectionist. Being outside the EU entailed a rise in trade friction, thus engendering additional costs leading to higher import prices. And this in turn, in the short run, would increase inflationary pressures. The country would become permanently poorer.

The rest of the paper analyses developments in the trade of goods and services since 2016, concentrating attention on the post 2019 period. It is a complex area, and the period coincides with a global Covid pandemic that clearly also affected demand and supply in both the UK and the EU. Despite this, evidence suggests that it is Brexit rather than Covid that is driving fundamental changes in post Brexit trade patterns. The recent resignation of Lord Frost also suggests that the desire of Leavers to impose their will on the EU has failed (for the time being). Some Leavers, and many businesses, are realizing a more realistic approach for living constructively with our largest trading partner across the Channel is needed. As is shown below the outcome differs from what both Leavers and Remainers expected.

Post-Brexit Trade Implications

Trade patterns during and after the Brexit process have not corresponded to the Leaver’s dreams and aspirations. On the goods side exports have declined globally, while they declined by slightly less to the EU. The share of exports going to the EU has remained almost constant. The general picture for total exports is that of falling volumes and increased sales to the EU. This is not to overlook the four product groups that have achieved both higher export volumes as well as reduced exposure to the EU, corresponding to the Leavers dream.

The complications arise on the import side. Here there was a 5% drop in imports to the UK, but a 9.2% drop in imports from the EU. While the government may seek to lay the blame for the reduced supply and empty shelves on Covid, it appears highly likely that additional bureaucracy and shortages of key personnel greatly exacerbated the situation. As a spokesman for the UK Road Haulage industry explained, there had been a structural weakness in the British road freight industry for decades, leading to an undue dependence on EU truck drivers to deliver material to this country. None of the Brexiteers appear to have been aware of this, even though the supply interruptions have caused great damage across the UK economy. Moreover, it has led to an increase in costs, particularly on account of higher fuel prices, which is, in turn, contributing to higher retail price inflation. There was a more significant shift away from the EU as a supplier, and the share of EU imports in total UK imports dropped by over 4%.

The overall characteristic of goods imports though shows lower volumes, and lower dependence on the EU. Four of the 10 product groups analysed have this pattern. Another four product groups have conformed to the Leaver’s dream, showing higher volumes and lower exposure to the EU. But it should be recalled that the product groups showing higher exposure to EU imports include Food/Livestock and Machinery and Transport, both important sectors for the economy. The post-Brexit trade experience, influenced by Covid, is significantly worse than expected by Leavers. Thus far, the scepticism of Remainers that foreign trade performance would deteriorate is justified. Moreover, the variation in trade performance by product group provides a fertile starting point on which to construct a more targeted approach to trade policy, and to learn more from countries such as Switzerland and Norway about how best to deal with unequal trading relations with the EU. UK government slogans about “bouncing back better” reveal the chasm that lies between the aspiration and the development of new trade policies.

The Goods Trade

Before examining the details of post-Brexit changes in trade flows, it is useful to put the short term volatility into a medium term context. This helps to give a scale for the recent perturbations.

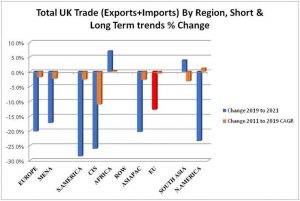

Chart 1

Chart 1 shows how total trade volumes in UK trade has changed by region and over two time periods. The longer time period (2011 to 2021) is shown with the orange bars, and the shorter term changes (2019 to 2021) by the blue bars. The red bar shows the short term reduction in total trade with the EU. The first thing to note is that the longer term changes are much more subdued, and are mostly negative. Trade volumes by regions have been gradually declining, with the exception of trade with North America and the EU, which rose very slightly over the decade.

The short term shock of Brexit (plus other factors) has been much more severe. This is shown with the blue bars. The short term impact of Brexit (plus other factors) has been strongly negative. There have been falls in trade volumes of over 20% with Europe (ex EU), the Middle East and North Africa (MENA), South America, the Confederation of Independent States (CIS-former Soviet Union). Africa and South Asia are the two regions where trade volumes have increase since 2019. The performance of trade with the EU has also declined, but by rather less than in many other regions. This is important since the EU is Britain’s largest trading partner. Nevertheless, total trade volumes with the EU declined by around 14% since 2019.

Table 1

Table 1 provides an overall summary of the changes in total exports and total imports, as well changes in exports and imports to/from the EU. The table shows that there was an 11.6% drop in export volumes to all markets. Exports to the EU dropped by a more modest 10.8%, very much in line with the global picture. The share of exports going to the EU fell by under 1%. This suggests that export relationships with the EU remain stronger than those with other markets. British exporters prefer maintaining links with their partners in the EU, who have persisted in ordering goods from the UK.

Imports have behaved differently. The overall import level dropped by 5% from all sources. Imports from the EU dropped by a larger 9.2%. Moreover, the share of imports from the EU dropped by over 4%. This is curious in that for the period under consideration, there were no tariffs, quotas and other limits placed on imports coming in from the EU. Other non tariff barriers start to bite in 2022.

One of the contributory factors for the decline in the EU share of imports is likely to have been the change in cabotage rules affecting EU inbound trucks[1]. The earlier EU rule limited drivers/trucks from other EU member states to 3 cabotage trips while in the UK. This was reduced to two trips post-Brexit. UK drivers taking freight to the EU are limited to just one cabotage trip, plus 2 cross border journeys. The combination of these moves, it is argued, far from “taking back control” contributed materially to extensive supply shortages, contributing to the decline in imports from the UK. Recent efforts by the UK government to relax the cabotage limits on EU trucks are not welcomed by the domestic British haulage industry. Changes in company business models affecting the flow of intermediate goods into the UK have also contributed to the drop in import volumes.

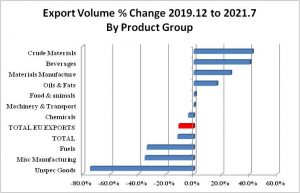

Chart 2: UK goods exports post-Brexit

Source: See notes section below, and author’s calculations. For a fuller description of Sector categories see Appendix 1 below.

In addition to trade effects on a regional basis, there are also trade effects by product groups. These are shown in charts 2 and 3, and illustrate the wide differences in trade performance by product group exports and imports. Chart 2 above shows that product groups that experienced a relatively good export performed include Crude Materials (largely metal ores, rubber, wood and various minerals), beverages and tobacco, materials manufacturing (rubber, paper, iron & steel), and oils and fats. Two sectors dependent on the EU, namely Food & Livestock and Machinery and Transport maintained export levels throughout the period. Major losses in exports were recorded in Miscellaneous Manufacturing (furniture, clothing/footwear, jewellery). Unspecified goods and fuels experienced severe declines in excess of 30%. Many of the exports in the miscellaneous manufacturing product group are supplied by Small and Medium sized firms.

Chart 3: Product Group Imports post-Brexit

Source: See notes section below, and author’s calculations. For a fuller description of Sector categories see appendix 1 below.

The position on imports differs. Overall import volumes fell by 5%, while imports from the EU fell by 9.2%. As with exports some product groups performed well, including Oils & Fats, Crude Materials, and Beverages, where import volumes increased by over 20%. Five product groups experienced falls in import volumes, in particular Machinery & Transport, and Food & Livestock. Fuel imports also declined. Food & Livestock and Machinery and Transport are both closely connected with the EU. In the case of food, this reflects a broader selection of imported foods, while in machinery and transport it reflects the import of finished vehicles as well as of components. Reduced imports in these sectors have knock on effects elsewhere in the economy, such as in large increases in the prices for second hand vehicles, as well as falls in output in the domestic motor vehicle industry. Chart 3 shows that while Covid related effects will have played a part, difficulties in supplying customers in the UK has probably played a more important role. The shortage of truck drivers owing to the change in cabotage arrangements, as well as visa and driver permit issues have been ongoing, and reflect deeper structural issues now exposed by Brexit.

Combining data on exports and imports reveals that at the end of 2019, the UK was running trade deficits in 7 of the 10 product groups. By mid 2021, this had risen to deficits in 9 out of the 10 groups. The overall trade deficit, as measured here, also increased by nearly £750 million, or by 3.6% on a monthly basis, contributing to an estimated trade deficit of over £21 billion.

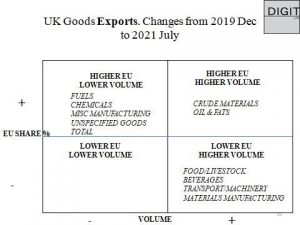

Chart 4: Changes in export volume and export intensity with the EU by Product Group.

Charts 4 and 5 summarize the changes in export and import volume by product group, compared with changes in the share of exports and imports with the EU. In a globalized post-Brexit economy, Leavers might hope the dependence on the EU to lessen, as British exporters aim to replicate the behaviour of their Elizabethan ancestors. The reality looks very different.

There are 4 product groups where export volumes fell, although their dependence on exports to the EU increased (the top left quadrant). Indeed, this is true for exports overall, that while volumes fell, dependence on the EU increased. There were no sectors that experienced a fall in volume, and a fall in the share of exports to the EU. There were two product groups where trade with the EU increased together with higher export volumes, crude materials and oil & fats. The second most important group with 4 product groups is where volumes increased, while the export share to the EU declined. This describes the situation for Food/Livestock, Beverages, Machinery and Transport and Materials manufacture – these are the export product groups that most closely match the Leavers’ aspirations. Note though, that for 6 product groups, the importance of the EU as an export market increased.

Chart 5: Changes in import volume and import intensity with the EU by Product Group.

Imports more closely resemble Leavers’ desires. 7 of the 10 product groups imported a lower proportion from the EU, while only 3 product groups increased their dependence on the EU, Food & Livestock, Fuels and Beverages. Taking imports as a whole volumes declined as did their dependence on the EU. Imports from the EU declined more than imports from the rest of the world.

Summary Goods Sector

The evidence presented here shows that actual post-Brexit trade experience has conformed neither to the Leavers, nor to Remainer’s expectations. Instead the experience has highlighted some paradoxes, some of which have been negatively affected by Covid:

- Exports have suffered a larger drop in value than imports.

- The share of exports sent to the EU has remained very steady, barely dropping

- The overall fall in import volumes has been lower than for exports. However, the share of imports from the EU has fallen more than the overall drop in imports

- There is not a great overlap in the behaviour of product group exports and imports, suggesting that individual sector factors are important determinants of trade volumes

- The top 3 export product groups are Crude materials, Beverages and Materials Manufacturing. The top three gains in import volume are Oils/Fats, Crude materials and beverages.

- This suggests that sector effects on volume are important for Beverages and Crude Materials

- There is only one product group that experienced drops in both import and export volumes, namely fuels. The product groups with the largest falls in exports are Miscellaneous Manufacturing and Unspecified goods. The product groups with the largest falls in import volumes are Food and Livestock and Machinery and Transportation.

- The most “typical” characteristic for exports is for lower volumes and higher share of exports delivered to the EU. This is very different from the Leaver’s goal.

- The most “typical” characteristic for imports is lower import volumes and reduced importance of EU sourced imports.

- While this might partially meet Leaver expectations, the reduction of import volumes, the reduction in the range of products on offer, shortages of drivers and increased bureaucracy are all reducing consumer choice, pushing up consumer prices and contributing to lower living standards, in marked contrast to Leaver expectations.

Trade In Services

One of the main attractions of the EU is that it is the only international organization that made specific arrangements to encourage and regulate trade in services between member states. Services are excluded from the WTO, and the only other places where there are regulations affecting cross border service trade are in federal countries such as the USA, Canada, Australia, Germany etc. In its haste to leave the EU, and after the demise of Mrs May, any thoughts of retaining membership of the internal EU market were abandoned, leading to a deterioration in business conditions for UK service providers, who can no longer export their services to the EU under pre-Brexit conditions. Notably this applies to the mutual recognition of technical standards, staff qualifications and mobility. It also affects the mutual recognition of capital requirements to support operations in the EU. Formerly capital based in the UK could be used to fund financial operations in the EU and vice versa. This is no longer the case, meaning additional costs face financial intermediaries who seek to continue doing business in both the UK and the EU. Many traders have had to essentially duplicate capital holdings so that EU operations are funded from an EU “pot”, while UK operations are funded from a UK “pot”.

The longer term situation for service trade with the EU is shown in chart 6 below. Between 2016 Quarter 1 and 2021 Quarter 2, there has been a very mild annual increase in Service Exports, less than 0.5% pa. There has been a larger average annual decrease of around 0.8% in service imports. This has led to a significant increase in the service trade surplus. This picture has been greatly disturbed. When one considers the period 2019 quarter 4, and plots the development of the trade components it becomes clear that a significant deterioration has occurred.

Chart 6:

However, there appears to be an inflection point in service exports from the UK after mid 2019. When measured since 2019 quarter 4, service exports to the EU have dropped by just under 25%. The drop in imports has been even more dramatic. From 2019 quarter 4 onwards service imports from the EU dropped by an astonishing 42%. There has been a decisive shift away from the normal seasonal pattern of EU service imports. Service imports from the EU appear to be in free fall. At the very least this is leading to a reduction in range of services on offer, and to reduced competition in services in the UK.

There is a silver lining in the service industry cloud. Even as overall service trade volumes have dropped, the disproportionate fall in service imports from the EU has increased the services trade surplus.

Services here are defined very broadly, and go far beyond financial services, important though they are. It is far from clear whether the drop in service imports is due to a lack of demand from the UK side – possibly exacerbated by Covid, or whether it is due to lack of supply, with EU suppliers being less willing to supply to the UK market. In the absence of any formal agreements between the EU and the UK government on service standards, it is possible that over time there will be increased pressures from the EU side to further restrict access of UK service exporters to the European Single market. This might, in turn, then put downward pressure on the UK’s services trade surplus with the EU. From a regional perspective, reductions in UK service exports to the EU will hurt London and the South East.

Notes

Data for this analysis was obtained from the Office of National Statistics, Trade Division, and the author would like to thank them for their assistance. The main links are:

[1] Cabotage refers to the ability for a freight carrier to pick up or deliver goods to intermediate destinations, and to make additional pick ups as part of a round trip journey. Cabotage rights apply to land, sea and air transport.

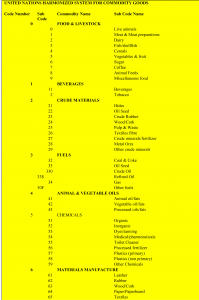

APPENDIX 1

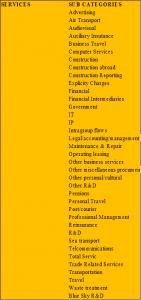

The data used for this paper came from the Office of National Statistics (ONS) Trade group. They alerted me to tables that showed trade flows both by commodity group and region. The trade figures can be looked at at various levels of disaggregation. The main classification used follows the United Nations Harmonized System of Commodity definitions. These are used for the purpose of allocating tariffs and quotas on internationally traded goods. In this paper we refer to the 10 two digit product group listings. The names of these groups is not as revealing as it could be. This appendix therefore shows the sub categories attached to the main 2 digit level names.

UNHS Goods and Commodities: Glossary and definitions

SERVCIE TRADE CATEGORIES

Leave A Comment