by John Stevens

Chairman of the Federal Trust; Former Member of the European Parliament (1989 – 1999)

4th May 2020

In the latest iteration of the unempathetic essence of their cause a debate is emerging amongst the supporters of Brexit over whether the crisis created by the COVID-19 virus will prove politically to be a help or a hindrance. It is most apparent in the issue of whether the United Kingdom should accept an extension of the transition period for leaving the European Union beyond the present deadline of the end of this year. But it also infuses discussion (or lack of it) over the appropriate exit strategy from the on-going lock-down and even impinges on collateral controversies as varied as those over the Government’s procurement of protective equipment for health and care workers and our future relations with China.

There is clearly a widespread fear that the fragile mandate for Brexit could be further, and even fatally, undermined by a comprehensive collapse of the economy. Recent history apart, caution remains a Conservative characteristic. And in this case it is compounded by a continuing confusion over the very meaning of Conservatism, which whilst a key component of the 2016 referendum result, now constitutes a severe threat to its coherent implementation. At the same time, there is equally clearly a growing claque proclaiming that such a collapse will not only serve to conceal the deep damage to trade and investment which Brexit already entails, and which even a very favourable outcome to the negotiations with the EU will further intensify, but offers near perfect preconditions for a radical re-making of the UK on extreme free-market lines.

So far, the proponents of this second prognosis seem set to prevail. Reactionaries thrive in recessions. And only the fiercest fanaticism can give at least a motivating facsimile of form and function to Brexit: a project so evidently lacking both. The reassertion in our national life of the status of the National Health Service, and of the state more generally, the revaluation of the low paid and immigrants, will not, by themselves, be sufficient to overcome the huge advantages the Government enjoys in the current British political system. Nor will be the advent of a new leader of the Labour Party, notwithstanding Sir Keir Starmer’s signal superiority over his wretched predecessor. Opposition can and will be swept aside. The suggestion last week in Mrs Truss’ statement on the initiation of trade negotiations with the United States, that these should take precedence over the conclusion of any agreement with the EU, combined with the almost simultaneous rejection by Mr Frost, in his talks with M. Barnier, of any serious European monitoring of post-Brexit trade across the Irish Sea, in accordance with the Withdrawal Agreement, are the clearest confirmation of the Government’s resolve.

However, once the overriding human health priorities created by COVID-19 are addressed and it is possible to assess its lasting social, economic and political consequences, there are solid grounds for pro-Europeans to anticipate a rather more optimistic outlook. Indeed, it is not impossible that these could create a real opportunity for reversing Brexit. British hostility to the European Union rests upon two essential economic propositions: that retaining sterling is a superior monetary strategy to the shared currency of the euro, and that globalisation is a superior commercial strategy to the shared regionalism of the Single Market. Both propositions are about to be destroyed in the imminent storm. The freedom to devalue will prove a serious impediment in an environment of cut-throat competitive debt issuance. And the freedom of offshore trade will prove a serious illusion in an environment of a radical re-shoring to home markets.

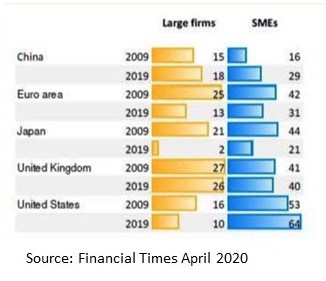

Amongst various indicators of the current vulnerability of sterling-based compared to euro-based fiscal expansion, the chart below setting out the levels of private sector debt both for large firms and for small and medium-sized enterprises now, compared to a decade ago at the height of the global financial crisis, is particularly striking. In the UK these are now comparable to those prevailing in that period of extreme stress, whereas they are respectively half and a third lower in the Eurozone.

Private debt as percentage of GDP:

Amongst various indicators of the amplification and acceleration of the negative impact of Brexit upon UK manufacturing precipitated by the present pandemic, the recent statements from Airbus and Nissan are particularly striking. It now seems most unlikely that either enterprise, faced with the most far-ranging rationalisation of their businesses for more than a generation, will long retain their capacity in this country. A similarly dire outlook seems in store for UK financial services. The change of emphasis in the European Central Bank’s contribution to the EU negotiating position last week is also particularly striking. In an ironic mirror-image of the perception of Brexiteers in London, opinion in Frankfurt, which whilst always determined to dismantle over time the City’s place in euro wholesale markets, had favoured an extremely gradual approach on matters such as equivalence and clearing, to avoid damaging disruption, has now shifted to a recognition that the case for caution has been comprehensively superseded by the scale of the restructuring of Eurozone government bond issuance, and of banking more generally, which now seems both unavoidable and urgent.

There is also the wider geopolitical dimension. Of particular note must be the way the virus, by destroying President Putin’s ill-timed attempt to squeeze out US shale oil and gas production, and by threatening, through the collapse of the rouble, his grip upon the affections of his oligarch backers, and, through its direct impact, his grip upon the affections of the Russian people, may well mark the beginning of the end of his rule, and remove one of European integration’s most resolute and insidious opponents. Of further significance must be how it has revealed deep deficiencies both in China and the United States. The need to face up to Chinese competitive capabilities, not to mention predatory practices, in the advanced technologies so central to the post COVID-19 recovery, offers the most powerful incentive yet for a co-ordinated European response: far more powerful surely than the old “defi Americaine”. A change in President this autumn, now a clear possibility, though it will not reverse the strong trends that are underway towards a more isolationist America, might well restore the pre-Trumpian US conviction that the EU is fundamentally an ally, not a rival, in preserving what used to be called Western interests and values in a world increasingly shaped by the rise of Asia and Africa. There is in fact at least a chance, that what will ultimately emerge from the crisis is a Europe capable, at last, of recovering its natural eminence in global affairs. How long will the British wish to remain semi-detached from that?