Is Europe losing the Internet race?

Some implications for the European Union of the 2015 Mary Meeker report on Internet trends

By Cameron Thomson*

September 2015

Download the article as pdf file

Introduction

Mary Meeker is an American venture capitalist and former Wall Street securities analyst who now works for the Silicon Valley venture capitalist firm Kleiner, Perkins, Caufield and Byers. Her primary focus is on the Internet and new technologies, and each year she publishes a well researched report on Internet trends. Her 2015 report was released in May, 2015 and covers a breadth of topics surrounding the Internet, new internet-based technologies, and the way these trends are affecting the way we behave as consumers, producers and as members of society. In the business world there is little that has escaped the impact of the Internet. With such a seismic shift there inevitably arise major threats, major opportunities and major shifts in the relative competitiveness of nations and regions.

In this report I summarise the key aspects of Meeker’s report, focusing on the changed work- and consumption-behaviour of the so-called “Millenials” (those currently between the ages of 21 and 33). I proceed to suggest potential consequences of these trends for the EU –particularly its most successful industries, and to its regulatory framework. I also examine the troubling and persistent question of the dearth of large European Internet firms, before suggesting what European firms and policy-makers can do to ensure the competitiveness of the EU’s economies and to allow Europe to adapt to and thrive in the digital world.

Changing work patterns

Meeker’s report focuses in part on the changes to the way we work and consume, arising from the development of the Internet and its effects on associated technologies. Comparing Millenials to members of Generation Y (aged 34 – 49) she finds, amongst various intergenerational differences such as family size and work priorities, that younger generations integrate technology into work life far more readily than before, perhaps unsurprisingly. In a survey by the Freelancer’s Union of 5000 working Americans, 45% used smartphones for work purposes, compared to 18% in older generations, and 34% preferred to collaborate online rather than via the telephone or in person (compared to 19% in previous generations).

The integration of the Internet into working life has had profound effects. Due to the increased viability of working from home, from abroad or at previously unsociable hours, workers are now able to work more flexibly. Of those interviewed in a similar study 38% worked as freelancers (an increase from 32%) and of those aged over 35, 20% identified as “night-owls”, meaning they regularly work outside normal business hours.

Changing consumer patterns

Thus a supply of flexible workers is facilitated by the Internet and demand for this flexibility is due to the Internet, too. The rise of online marketplaces such as eBay, Etsy, and Amazon has released consumers from the constraints on brick-and-mortar shops such as travelling time and costs, and trading hours. As such, with the increase in demand for essentially 24-hour marketplaces, firms start to demand more and more versatile workers. As Meeker puts it, “consumers’ expectation that they can get what they want with ease and speed will continue to rise… this changes fundamental underpinnings of business and can create rising demand for flexible workers”

The growth of a flexible labour supply extends past online marketplaces to other sectors, in what is known as the “on-demand economy”: well-known examples include Airbnb, Uber, HelloFresh and Etsy. An “on-demand worker” is defined by MBO Partners as someone who engages in “economic activity through the use of online platforms and marketplaces that help customers quickly connect and transact with suppliers of goods and services”. The on-demand economy allows society, as put in an article in The Economist, to “tap into its under-used resources” – before Airbnb or Uber there were a number of underused resources, namely guest rooms and cars, which these on-demand firms can connect, using the internet, with people demanding them.

The growth of the online economy, and within that, particularly, the on-demand economy, is not slowing: from 1998-2014, online commerce as a share of total sales in USA has gone from 1% to 9%. Google, Amazon, Alibaba and Facebook are established giants; Uber, founded in 2009 in San Francisco, now has revenues totalling $1 billion per annum and a value of about $40 billion.

There are obvious benefits available to EU countries of the increasing role played by the internet in economic life. A significant reduction in entry costs to many markets provides more competition – this is well illustrated by Uber, which operates in an industry known not only in Europe but the world over for its restrictive entry rules and powerful incumbents. In many European cities, where the choices available are limited for a would-be taxi driver who can’t afford steep license or training fees, Uber allows quick market entry with the only required capital being a car and a smartphone. The full extent and implications of the competition spurred on by the Internet is a subject covered later in this report. Other benefits include the ability to work flexibly and according to your own schedule, as well as the opportunities for time-rich but cash-poor people to supplement their existing income: again, little capital is required to set up shop as an eBay seller (even if capital is required, the development of online crowdfunding platforms like Funding Circle make this process easier).

There are, of course, downsides to this shift in the workings of European economies, particularly in the case of on-demand workers. With more flexibility comes more risk – on-demand workers have no fixed income and so face more uncertainty in planning and spending. They also often lose out on traditional employee benefits, even when they feel and appear to be employees – a high profile example of this is the ongoing legal disputes between Uber, Lyft and their “sub-contractors”.

New EU regulatory challenges arising

These disputes revolve often around the continuing efforts of Uber and Lyft to classify their drivers as subcontractors, rather than employees – the implications of this being that the firms are under no obligation to pay social security, unemployment insurance and workers’ compensation. Both Uber and Lyft were ruled against in March by District Judges in San Francisco, in favour of their drivers whose expenses, mostly fuel- and maintenance-based, were previously unpaid by the companies. These court decisions effectively force the companies to shift back towards the traditional relationships between company and individual, relationships which are arguably anachronistic in the age of the on-demand economy. Such rulings not only reduce the profitability of on-demand firms, but also the benefits brought by such firms to those drivers (in this case) desiring the flexible work on offer.

The apparently anachronistic set of regulations hampering the on-demand economy are not limited to the travel sector, as illustrated by relatively high-profile legal disputes concerning Airbnb and Stubhub. For the former this consisted of the case of Nigel Warren, a host for Airbnb who was fined by the New York City Environmental Control Board for renting out a room from his apartment. Warren (and Airbnb) successfully had the decision reversed, demonstrating perhaps that existing regulations are not necessarily the limiting factor, but rather the arguably overly zealous authorities whose job it is to interpret them. Stubhub, an online secondary-marketplace for those wishing to resell tickets to events, faced legal hurdles in the form of US anti-scalping laws, which took heavy lobbying and the passing of an amendment to the laws in 2006 to surpass.

The way in which existing regulation tends to be unprepared for the advent of the on-demand economy was captured well by Airbnb’s CEO in light of the NYC vs Nigel Warren dispute:

“There are laws for people and there are laws for business. What happens when a person becomes a business? Suddenly these laws feel a little bit outdated. They’re really 20th-century laws, and we’re in a 21st-century economy”.

Some of these regulatory issues are present only on a case-by-case basis, for example the US’s anti-scalping laws. Labour-market regulations however, which seem inadequate in classifying those who work for on-demand firms like Uber, Lyft and Airbnb, may require a systematic rethink. Such will be the opinion, at least, of the myriad on-demand firms who have observed the defeat of Uber and will know the potential implications for their own business practices.

The EU regulatory response

There have been efforts in the EU to take account of this new type of worker, named in an EU-commissioned study as economically dependent workers, or “quasi-subordinate workers”. These workers, according to the study, find themselves in a regulatory grey area between self-employment and subordinate employment, and are described as not having “an employment contract as dependent employees – but who are economically dependent on a single employer for their source of income.

Different EU countries classify these workers in different ways, with the frequent motivation of extending social security (National Insurance payments, for example) rights and obligations. This makes sense both from a political perspective (in light of rising disapprobation over the increasing numbers of workers left without any employment benefits or protection) and from an accounting one (with a greater need than ever to increase payments into social security programmes). Some attempt to use certain tests on a case-by-case basis, effectively shoehorning workers into one of the two established categories. The UK, for example, uses four such tests, based on:

- Mutuality of Obligation – “what evidence is there of formal subordination to contract terms?”

- Integration – “how integral is the work to the business?”

- Control – “who holds control over task, mode, means and timing?”

- Economic Reality – “where does the financial risk lie?”

As the report details, the regulatory approach of many EU countries has shifted from one which focuses on the balance of risk as the major factor in classification to one which focuses on the legal subordination of the worker to the employer – that is to say, the employer’s “right to direct, supervise and control the work performed”.

Such tests are not perfect: as the report says, “the outcome [of the tests] is often controversial and the tests can counter each other, leading to a high level of uncertainty. Similar situations are reported also for the other [EU] countries.”

Other EU countries, such as Ireland and Austria, take the stance that maintaining the binary classificatory system is unsustainable as these two categories fail to capture the nature of this new type of employment. They attempt therefore to create a new intermediate employment status (or multiple statuses), which often consist of the extension of social security obligations to workers and employers, and, to an extent less than that found in traditional subordinate worker employment, the legal requirement of some in-work benefits like parental leave or sick pay.

At this juncture European policymakers face a potential conflict of interests. On the one hand, there is significant appetite for extending all provisions and protections for traditionally subordinate workers to those considered quasi-subordinate. This essentially renders subordinate and quasi-subordinate workers equal in terms of their handling by the law, and is the approach favoured by Trade Unions and other groups concerned primarily with worker welfare. The promotion of workers’ rights and welfare is, after all, one of the principal objectives of the EU. On the other hand it is frequently argued that by rendering subordinate and quasi-subordinate workers the same the EU hampers the workings of the labour market, reducing labour adaptability and hinder another official EU objective – the support of “entrepreneurial activity” – and that unless policymakers want to weigh down European firms and reduce their competitiveness globally, they must retain and encourage some labour market adaptability.

Aside from associated practical issues (should a subcontracted cleaner or taxi-driver face the same regulation as, say, a partially freelance financial consultant, if they are both quasi-subordinate?), the afore-mentioned tension between competitiveness and worker’s welfare is a major obstacle to effective legislation for any set of policy-makers, including those of the EU. Another major tension, more unique to the European Union, is that between national sovereignty and multilateral, EU-wide continuity in regulation: one major up-shot is that there is significant variation in policy between EU member states regarding labour regulation. This policy fragmentation is less of an issue than in the case of the EU’s policies regarding tech start-ups and the Digital Single Market, but is an issue nonetheless insofar as it creates confusion and could restrict the on-demand economy to limited parts of Europe. On the other hand, it is fair to say that there is no one definitive answer that has yet been found regarding how to adapt to this change in the labour market, and so some argue that allowing policy experimentation and variety on a unilateral basis is the most effective way to arrive at suitable policy for the whole EU.

Why aren’t there any big EU Internet companies?

From a European point of view, a worrying feature of Meeker’s report is the lack of successful European Internet companies. The indicator of the state of European tech is also arguably evidence of the ability – or lack thereof – of the EU to adapt to and thrive in a world influenced so profoundly by the rise of the Internet and digital technology.

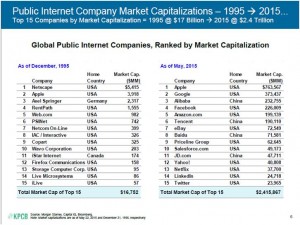

As shown, the number of large European Internet companies in 1995 was disproportionately small – now it is even more so, with not one European firm in the top 15, which is constituted entirely of US (11) and Chinese (4) firms. Out of the top 100, Europe manages a paltry 7, according to Bloomberg.

Common explanations for this include education and culture. European education does not prepare children for a future in which technological aptitude will be just as important as literacy and numeracy, it is claimed. Cultural explanations centre on the perception of Europeans as far more risk-averse and disapproving of failed business ventures. An article in the Economist claims that:

‘In Europe starting your own company has long carried higher risks and lower rewards than across the Atlantic. In America, a failed start-up tends to be a badge of honour; in Europe, it often spells professional death’

Business Insider UK puts it down to a less individualistic culture, and other commentators have proposed that American consumers are more willing to try new products, making them attractive as new customers for budding companies. But these explanations, though they may have some merit as contributory factors, cannot fully explain the failure of European Internet companies to take off on a global scale.

With regard to the first claim, it is simply wrong to blame Europe’s failure on technological illiteracy. High-profile cases such as Sir Tim Berners-Lee’s seminal contribution to what became the World Wide Web, or France’s Minitel, demonstrate that the skills and innovative appetite are there. There are plenty of European tech start-ups, frequently emerging in hubs such as “Silicon Fen” (Cambridgeshire), Siliconallee (Berlin), and Silicon Roundabout (Old Street, London). As regards the second, cultural explanation – there are both more conformist and more poorly educated societies such as – to an extent – China which clearly enjoy more success than Europe in this arena. To more fully understand the problem it is necessary to examine the politics and history of Europe compared to the US, to explain their disparate fortunes in producing big tech firms.

There are two primary reasons for the dearth of European companies amongst the upper ranks of international Internet technology: in short, history and fragmentation. These two factors are linked and mutually perpetuating.

It is perhaps most illuminating to draw a contrast between Europe and the USA, and many believe the key to the latter’s dazzling success in tech to lie in its post-war history. Albeit in a period of global growth, the USA’s economy surpassed all others in the scale of its expansion, with its population slowly becoming among the world’s most educated as a result of the expansion of government investment in higher education, whilst its capital markets have been the most developed and sophisticated for many decades. A relatively educated workforce provides the labour for tech start-ups (aided however by quite a liberal approach to skilled immigration – according to Vivek Wadwha, 52.4% of Silicon Valley startups had one or more immigrants as a key founder); in contrast to the EU’s brain drain of tech firms to the US and Asia, highly developed capital markets willing to take risks ensure that the US retains promising start-ups, even when they are bought out by investors.

A combination of improving material wealth as well as a better educated populace contributed towards the creation of optimal conditions for the proliferation of tech start-ups. Crucial, though, was the significant amount of US public spending on military technology and the bolstering effects this had on a fledgling American technology sector, as new military technologies were adapted for civilian use. Europe of course had some of these factors present, but not on the same scale as found in America – as such, the stage was set for tech firms to flourish in the US to an extent not found anywhere else in the world, let alone in Europe. In an interview, Liam Boogar, the co-founder of Paris-based tech-blog Rude Baguette, compared this head start to that enjoyed by Henry Ford in the early days of the automobile industry.

If this were the only factor inhibiting Europe’ tech firms the solution would be relatively simple, if long-term and difficult to achieve – encourage economic growth, investment into technology, and a focus on education. There is, however, a far more pernicious and problematic issue keeping “Euro-tech” suppressed: namely cultural, linguistic and regulatory fragmentation. What these three subsets bear in common is the imposition of additional costs onto tech firms, and the subsequent stymieing of European firms who might otherwise reach the heights of Google and Apple.

Perhaps the most damaging form of fragmentation concerns culture and language. The EU contains roughly 500 million inhabitants (and Europe 740 million). As a consequence, it might be assumed, the potential market for new products is even larger than the USA’s 320 million – and this is technically true. However to believe this is to ignore the fact that Europe is far more culturally fragmented than the USA – as Boogar puts it, “I’ve never met a European”. Different cultures require different approaches to marketing and PR, with considerations for various national idiosyncrasies and sensitivities; language differences require multiple translations for websites and apps. Both of these phenomena can be viewed as barriers to entry which impose costs on European start-ups, costs not borne by their US counterparts in the initial stages of their development. For example a Danish entrepreneur wishing to expand the across Europe will have to translate material into dozens of languages and create dozens of different advertising campaigns – an equivalent company in San Francisco will have no such problem, given the linguistic and (relatively) cultural homogeneity they face. Such cultural fragmentation belies the presentation to outsiders of Europe as broadly unified. Tech media outlets, traditionally the champions of new firms with good ideas, are also restricted by cross-country cultural/linguistic barriers, rendering mute their otherwise amplifying effects.

A more substantive – and arguably more limiting – form of fragmentation concerns regulation, and the costs it imposes on ambitious tech firms. A cursory glance at online EU documents concerning regulation (be it of labour markets or of technology) is telling, inasmuch as it will often refer to the actions of “individual states” when discussing policy across the EU, rather than EU-wide policy. Again, this fragmentation imposes costs on European tech firms, who must pay different taxes and spend more time adjusting their structure and services country by country. The consequence of this regulatory burden is often the need to hire lawyers to ensure such adjustments are compliant with individual sets of regulations. Regulatory fragmentation affects not only the behaviour of producers, but of consumers too – streaming laws mean that only 4% of content downloaded online in the EU is available across borders, and most smartphone contracts prevent data-roaming abroad or make it more difficult.

What is being done, and what more needs to be done?

Efforts to counteract this fragmentation have been direct and indirect, and have had varying degrees of success. Recent years have seen the rise of technology “incubators” or “accelerators”, such as Seedcamp or Techhub. Such organisations provide physical and virtual space for start-ups to use to run their businesses, connect them with investors via networking events, give them added publicity, and sometimes provide certain levels of seed investment – Seedcamp for example has 174 investments in 163 start-ups. The help provided by incubators and accelerators is well documented, and the state of the incubator industry has improved significantly – in 2011 commenting on their proliferation in an article for Techcrunch.com, Mike Butcher referred to the European incubator market as “white-hot”. The help given by incubators to start-ups may go some way to counteracting some of the aforementioned disadvantages faced by European start-ups – business and legal advice from those with expertise can alleviate some problems caused by regulatory and cultural fragmentation, for example.

However, incubators alone are not the answer. Along with their proliferation have come concerns over their efficacy – in Butcher’s article he references Max Niederhofer, CEO of Qwerly and a former venture capitalist with Atlas Ventures, who expressed worries that many incubators were in effect vultures, aiming primarily to latch on to promising start-ups without providing any valuable services. Other commentators have noted that the amount invested by incubators is often trivially small and ineffective, compared to the investments made traditionally by venture capitalists.

In terms of policy, there have indeed been significant efforts to reduce regulatory fragmentation, in the form of the EU’s Digital Single Market programme (part of the “Europe 2020” strategy). The programme revolves around three pillars of “Economy/Society”, “Access” and “Environment”. These pillars overlap considerably, and concern many different policy areas, such as the improvement of 4G networks and internet coverage across the EU, and increasing average connection speeds from their current level (only 1 in 4 connections in the EU are above a relatively paltry 30Mb/s). Most relevant to European tech start-ups however is the programme’s promotion of EU-wide policy on data-roaming, copyright law, VAT, downloads and cloud technology. Such measures have gone and will go some distance to reducing fragmentation, but there is a limit to what the DSM can do: from the outset it has faced significant resistance from some EU leaders, who fear a removal of national sovereignty in policy regarding, for example, 4G/5G spectrums. This reluctance to devolve more policy-making power (which commentators like Boogar see as a necessary – if not sufficient – measure to improve Eurotech’s fortunes) is exacerbated by a post-crisis Europe in which national political narratives seem to favour ever further, rather than closer, union.

Conclusion

Recent high-profile clashes with large internet firms like Google show the EU’s direction regarding the effects of the internet on economic and social life to be, if not in a crisis, then at a critical juncture. Crucially, they illustrate a political body seemingly at odds with itself. Whatever the genuine merits of the EU’s actions in such cases, it is difficult to portray a Europe readily adapting to the demands and challenges of the Internet when public discourse is dominated by arguably tokenistic and populist gestures, despite the efforts of policy makers in the form of the DSM, for example.

An important directive for the EU with regard to Internet start-ups is to reduce government involvement, at least in the view of some prominent tech commentators; it is commonly remarked that you cannot regulate a firm into existence. Start-ups, particularly in the case of Internet based ones, require more flexibility than traditionally rigid and intrusive business regulation allows.

The principal finding of this report however, concerns both issues indicative of the EU’s ability to survive and thrive in an internet-altered world – that is, firstly the afore-mentioned challenge of allowing and helping start-ups to grow larger in the EU, and secondly the changing demands on labour regulation. In both cases, the search for a solution seems to point consistently in the direction of further powers being accrued into EU hands, away from national sovereignty – or at the very least, far greater coordination of EU-wide policy. Regulatory homogeneity would go some way to ameliorating the effects of fragmentation on the ability of European internet start-ups to access large markets, reducing barriers to entry into Spanish markets for Swedish entrepreneurs – this would not, it must be noted, be by any means a panacea. Regulatory consistency would also allow EU countries to maintain their professed dedication to protecting the rights of workers in changing work conditions whilst sending a clear signal to on-demand entrepreneurs that Europe welcomes, within limits, their innovations – which, it should be remembered, bring benefits as well as challenges – and will not stick its head in the sand regarding global economic changes.

The trends identified by Mary Meeker present urgent and complex challenges for the progress of European economic union, particularly due to the fiercely guarded regulatory and cultural heterogeneity of its member states. Whatever the political appetite to do so, it appears that this heterogeneity may well have to be compromised in order to deal with them.

* Cameron Thomson is is studying Philosophy, Politics and Economics at Christ Church, Oxford. In 2015, as a Global Policy Institute summer school research project, he looked at the Mary Meeker 2015 Internet trends report and analysed the implications for Europe.